Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

– Boosting the mining sector

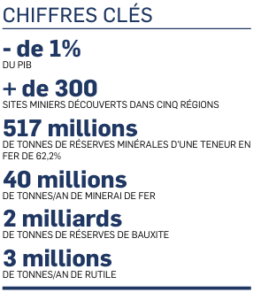

The mining sector accounts for less than 11.3% of GDP and less than 0.11% of exports. Yet the country possesses immense resources, notably iron ore and bauxite, the exploitation of which could propel the sector into one of the most important sectors of the local economy.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

Cameroon boasts significant mineral reserves. In 2019, Cameroon's subsoil revealed new riches: no fewer than 300 mineral discoveries were made in five regions of the national triangle. The Northwest, Center, West, Adamawa, East, North, and Far North contain minerals such as cobalt, copper, nickel, gold, rare earths, rutile, and manganese. In addition, base metals such as lead and zinc are also present. Other resources could emerge. According to experts, Cameroon's mining potential is only known to the extent of 40%.

Huge iron ore and bauxite reserves have long been identified in Cameroon, but a lack of transport capacity has hampered their exploitation. However, ongoing rail developments promise to accelerate their development. Many projects are nearing completion. The Bénéné deposit has a mineable reserve of 34.9 million tonnes of raw bauxite ore with an average alumina content of 51.9%. The company will mine 1.5 million tonnes of bauxite per year over a 20-year period. The ore will initially be exported from the Minim Martap mine of Australian company Canyon Resources, which will develop the mine with its partner Zhongye Changtian International Engineering Corporation (MCC-CIE). Camrail will transport up to 5 million tonnes/year to Douala in Phase 1, possibly as early as the end of 2023, but in the long term, Canyon aims to use the deeper port of Kribi. Investors will be able to use much of the same railway and a new line is planned to be built branching off the main railway to Kribi.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

The National Mining Company (Sonamines), a young public company, is now responsible for defending the state's interests in the sector. Sonamines has entered into two production-sharing agreements with Cimenteries du Cameroun (Cimencam, a Holcim group) for the exploitation of limestone in Figuil in the north of the country and for the development of their new clinker and cement production plant, which is scheduled to begin operations in 2023 for an investment of 50 billion CFA francs (over 76.2 million euros). To carry out its projects financially, Sonamines has Special Purpose Vehicles (SPVs) or common debt funds (FCCs), these co-ownership financing vehicles allowing the issuance of debt shares that are resold to investors.

Furthermore, to channel gold mining, Sonamines is trying to rein in gold mining activities to increase state revenue. It aims to achieve a target of 200 kilos by 2022, representing 5 billion CFA francs in revenue.

If Cameroonian mines keep their promises, through the major development projects at the Mbalam and G-Stones sites for iron, Lomié for cobalt and nickel, Minim Martap for bauxite and Akonolinga for rutile, Sonamines will systematically inherit 10% of the shares – a percentage that could rise to 25%. From barely 1% currently, the sector's share of national wealth is expected to increase tenfold by the end of the decade.

On July 1, 2022, President Paul Biya signed a decree granting Sinosteel Cam SA, a subsidiary of China's Sinosteel, a mining permit for the Lobé iron ore deposit in Kribi. This mining title covers an area of 138 km² with an estimated mineral potential of 632.8 million tonnes of iron ore. This agreement, with an initial term of 10 years, provides for the annual production of 4 million tonnes of iron ore enriched to 60%, which will then be shipped via the port of Kribi. The expected annual revenue for the Cameroonian government is estimated at 22.9 billion $, excluding taxes and dividends.

The rutile deposit identified in the Akonolinga area, in the central region of the country, is expected to be exploited starting in 2025 by the French group Eramet, which is responsible for developing this mining project. Eramet is one of the most successful mining companies in Cameroon. The upcoming results could make Cameroon a global rutile giant. Currently, Cameroon's rutile potential is close to 3 million tonnes, making the country the world's second-largest reserve of this mineral, behind Sierra Leone.

OPPORTUNITIES

With the latest mining discoveries, Cameroon is expected to become the new destination for mining projects in Africa, attracting new investors. 60% of the national territory have not yet been explored. These 60% are therefore open to potential investors in terms of mining research. It is worth noting the long-term development of a processing industry. The mining code provides for at least 15% of processing of ores produced locally.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference